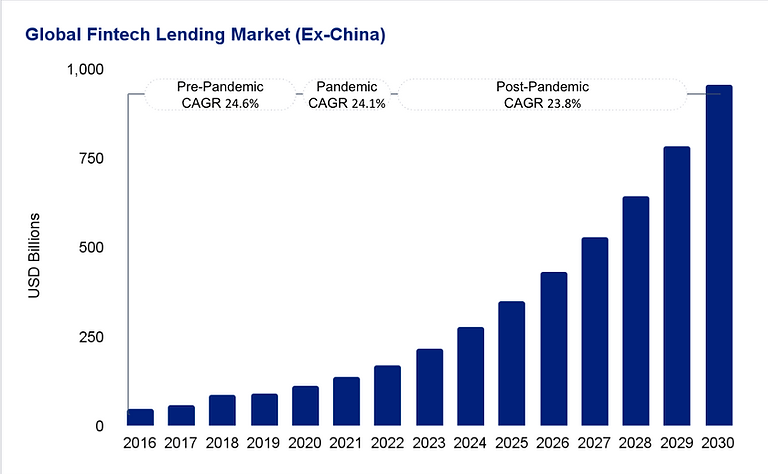

Fintech Lending: A 4.6X TAM growth opportunity towards USD $1 Trillion

FinTech, the set of services and products related to financial technology, has emerged as an innovation capable of disrupting the banking industry.

Despite its significant surge during the Covid-19 pandemic, the full potential of the sector has yet to be realized. One area within FinTech that offers high growth prospects is lending.

FinTech lending encompasses a broad range of services and products that takes advantage

of technology to facilitate the provision of credit. It has rapidly grown over the years but

there are still great opportunities to be explored, especially in emerging economies, where

many individuals and small enterprises struggle to get access to credit. Nonetheless in

developed markets, Germany and Italy stand out as notable examples in Europe. These are

countries in which the amount of private savings is extremely high, albeit broadly low-

yielding money market instruments, and the management of these resources is still largely

concentrated within traditional banks.

FinTech lending presents opportunities for individuals or institutions with excess cash to

earn high-yield returns by participating in peer-to-peer (P2P) or peer-to-business (P2B)

lending platforms. These platforms essentially act as marketplaces, connecting lenders with

borrowers in a streamlined and efficient manner.

In P2P lending, individual investors can directly lend money to consumers or small

businesses, cutting out traditional financial intermediaries such as banks. This allows

borrowers to access credit more easily and often at competitive rates, while lenders have

the potential to earn attractive returns on their investments.

Similarly, P2B lending involves businesses or institutional investors lending money to small

or medium-sized enterprises (SMEs) that may have difficulty obtaining financing from

traditional banks. Bypassing traditional lending channels, P2B lending platforms can provide

quicker access to capital for businesses and potentially offer better returns for investors.

These FinTech lending platforms often leverage technology, data analytics, and credit assessment algorithms to assess the creditworthiness of borrowers, mitigating risks for lenders and making the lending process more efficient.

Overall, FinTech lending and P2P/P2B lending marketplaces play a crucial role in expanding financial inclusion and enhancing access to credit for individuals and businesses while providing attractive investment opportunities for those with excess capital.

The roots of the high growth potential of FinTech lending originates from several factors. Firstly, the prevalence of technology adoption and digital connectivity in these economies creates a conducive environment for the delivery of the mentioned services. The widespread use of smartphones, internet connectivity, and digital platforms enables borrowers to access credit conveniently and efficiently. Additionally, the availability of comprehensive digital data allows FinTech lenders to employ advanced algorithms and analytics for credit assessment, resulting in more accurate risk evaluation and tailored loan offers.

As a matter of fact, Fintech lending platforms have revolutionized the lending process by leveraging data and technology in innovative ways, enabling them to provide faster and more efficient services compared to traditional financial institutions.

Fintech lenders connect to a wide array of data sources via Application Programming Interfaces (APIs). These sources include credit bureaus databases (credit scores, outstanding debts, repayment history), open banking platforms such as Information service providers and payment initiation service providers, government agencies, tax authorities, utilities, telcos and more. By integrating these diverse data sets seamlessly, fintech platforms create a comprehensive profile of the borrower with daily, weekly and monthly updates, improving surveillance and reducing default risk.. Fintech lenders access this data in real-time, eliminating the need for borrowers to submit physical documents or wait for manual credit checks.

Fintech lenders analyze consumer payment behavior from open sources, such as online transactions, utility bill payments, and rent payments. This real-time assessment of a borrower's financial activity provides additional insights into their creditworthiness beyond traditional credit reports.

Through open banking APIs, fintech lenders can access a borrower's bank accounts balances and transaction history . This allows for a detailed analysis of income, expenses, and spending patterns. It also provides verification of financial information without the need for paper statements or manual verification processes.

Top performing Fintech lenders develop sophisticated statistical models that incorporate all available data sources. These models utilize machine learning and artificial intelligence to identify trends, patterns, and anomalies in borrower data, allowing a more accurate risk assessment and fraud detection and predict borrowers’ creditworthiness and their ability to repay a loan. These algorithms can process vast amounts of data quickly and accurately, resulting in faster credit decisions.

By combining all these data sources, analytical tools and highly automated processes, fintech lenders have created a holistic and real-time assessment of a borrower's credit behavior and income generation.

Moreover, traditional banking systems often face limitations in providing credit to certain segments of the population. This is due to stringent eligibility criteria, lengthy approval processes, or lack of collateral. FinTech lending fills this gap by employing alternative data sources and innovative credit assessment models as well as alternative default mitigants. This allows for more inclusive access to credit, benefiting individuals and businesses that may have previously been excluded from traditional lending channels.

Furthermore, FinTech lending offers enhanced transparency and improved user experiences compared to traditional lending methods. Borrowers can access and manage their loan applications through intuitive digital platforms, enabling them to track the progress of their applications and receive quick decisions. The streamlined processes reduce paperwork and bureaucracy, resulting in faster loan disbursements and higher customer satisfaction.

Additionally, FinTech lending also provides benefits to lenders and investors. The use of advanced technology and data analytics allows for more efficient risk management and underwriting processes, reducing potential defaults and improving portfolio performances. Furthermore, FinTech lending platforms often provide opportunities for individual investors to participate in lending activities, opening up a new avenue for diversification and potential returns. The potential for growth in FinTech lending extends to emerging markets, where access to traditional banking services may be limited. FinTech lending could represent the instrument to fill the financial inclusion gap. Through mobile technology and alternative data sources, credit could be guaranteed to underserved populations, stimulating economic growth in those areas.

At the same time, FinTech lending presents challenges and risks i.e., safeguarding the privacy of the provided data and preventing eventual IT security threats. Additionally, as the sector continues to evolve, regulatory frameworks need to adapt to ensure consumer protection and maintain financial stability. Furthermore, the potential for algorithmic bias and discriminatory lending practices must be addressed to ensure fair and equitable access to credit.

Consumer vs SME lending

In fintech lending, there are marked differences between consumer lending and small and medium-sized enterprise lending. Consumer lending focuses on providing individuals with access to quick and convenient financing solutions. Fintech platforms specializing in consumer lending leverage technology and data analytics to assess creditworthiness, granting credit through personal loans, credit cards, or other forms of consumer credit online. These platforms often offer simplified application processes, competitive interest rates, and lendings tailored to the needs of each borrower.

On the other hand, SME lending in FinTech focuses on financing needs of small and medium-sized businesses. Like in consumer lending, platforms utilize advanced algorithms and alternative data sources to assess the creditworthiness of businesses that may not meet the traditional lending criteria of banks. Fintech SME lenders offer a range of financial products such as working capital loans, invoice financing, equipment financing, and trade finance. By providing efficient and accessible funding options, fintech platforms play a vital role in supporting the growth and development of SMEs.

Both consumer and SME lending in fintech share common advantages such as speed, convenience, and access to capital for underserved segments. However, SME lending involves additional complexity due to the varying needs and risk profiles of businesses compared to individual consumers. Therefore, fintech platforms engaged in SME lending often employ more robust risk assessment models to make informed lending decisions.

The results produced by EY survey state that the great majority of small and medium-sized enterprises are interested in having faster access to credit. This feature represents one of the most notable benefits of FinTech lending.

As a matter of fact, thanks to technology, the application process is typically more streamlined and efficient compared to traditional banks. This attracts SMEs that often require quick access to funds for various purposes, such as managing cash flow or seizing business opportunities. This need is proven by the fact that 55% of SMEs would like to be funded within 5 days; the percentage remains remarkable (33%) if funding within 3 days is considered. Secondly, fintech lenders tend to have more flexible eligibility criteria and consider alternative data sources, allowing them to assess the creditworthiness of SMEs that may not meet the stringent requirements of traditional lenders. This increases the chances of approval for SMEs with limited credit history or unconventional financial profiles. Additionally, fintech lending platforms often provide solutions tailored to the unique needs of SMEs, such as flexible repayment terms and customized loan structures. Lastly, fintech lending can be more accessible geographically, as online platforms enable SMEs to access funding regardless of their physical location. All these elements lead to a high percentage of SMEs (56%) that have decided to adopt FinTech services, even though traditional banking is still rooted in the economic system and is preferred by 63% of small and medium enterprises.

How incumbents are adopting fintechlike solutions.

Traditional financial institutions have recognized the transformative potential of fintech innovation and have been actively integrating it into their platforms. They have adopted fintech solutions to enhance customer experiences, streamline internal processes, and improve overall efficiency. This integration includes the adoption of digital payment methods, the implementation of blockchain technology for secure and transparent transactions, the development of mobile banking apps, and the use of data analytics and artificial intelligence to improve risk assessment and customer service.

Traditional banks are increasingly partnering with fintech startups or acquiring them to leverage their technological expertise and stay competitive in the rapidly evolving financial landscape. This integration of fintech innovations not only benefits these institutions but also brings modern, convenient, and customer-centric services to their clients. We believe that there is space for M&A activity to take place among incumbents and top performing fintech lenders.

Types of financing Fintech lenders and the benefits of alternative instruments such as ABS and venture debt..

Fintech Lenders TAM by 2030 is expected to reach USD $1 Trillion (Ex-China)

For the purpose of this report we have excluded China due to its regulatory changes impacting negatively growth and potential for growth of this industry.

The total addressable market of fintech lenders excluding China in 2016 reached USD $47 billion and faced significant growth during the pre-pandemic years reaching close to the hundred billion mark, consolidating annual growth of 24.64%.

During the pandemic the industry showed resilience achieving USD $113 billions, reaching a growth rate of 24.18%, regardless of a mixed result of countries which liquidity was significantly impacted and faced significant reduction of volumes, while others such as the UK, faced a surge of volumes due to government agencies providing financing support to SMEs through commercial loans instruments backed by the government through fintech lenders.

We estimate that during the period 2021 and 2022, this industry will continue at average annual growth rates of 22.77%, reaching USD $170 billion.

During 2023, APG has seen a significant increase from professional investors and institutional investors that once had appetite for a 20% annual return and were using equity instruments to achieve such expectations, towards alternative lending through the financing of fintech lenders, as some of their underlying books can generate mid teens returns for investors in asset backed, if not more in the case of venture debt.

In this regard, we expect during 2024 and 2025 a pickup of up to 5% over the average historical annual growth rate of this industry consolidating a total of 27% annual growth, followed by a gradual reduction of this pickup by 2028 and slower growth rate during the maturity period of 2028-2030 towards a 21% annual growth rate, allowing fintech lenders to reach USD $1 Trillion TAM by the end of 2030.

Source: APG estimations with historical data from Global Alternative Finance Market Benchmarking Report, Cambridge Center for Alternative Finance, University of Cambridge, Judge Business School.

Sources:

Global Alternative Finance Market Benchmarking Report, Cambridge Center for Alternative Finance, University of Cambridge, Judge Business School.

“FinTech Lending”, Sep 2022 https://www.bancaditalia.it/pubblicazioni/altri-atti-seminari/2022/Fuster_paper.pdf

“Le piattaforme FinTech di prestito e di raccolta di finanziamenti nel mondo e in Italia”, Giugno 2022, https://www.bancaditalia.it/pubblicazioni/qef/2022-0702/QEF_702_22.pdf?language_id=1

“Why digital lending is the future for banks and SMEs”, https://www.ey.com/en_it/financial-services-emeia/why-digital-lending-is-the-future-for-banks-and-smes

.png)